Hey Guys,

KiwiSaver seems to be the go to retirement fund in NZ mainly because the NZ Government has pretty much forced anyone who doesn’t opt out of the forced savings for retirement within the 8 week time frame to be simply locked in until retirement (65).

I joined my KiwiSaver back when it first came into existence. I joined with Westpac and had a conservative scheme with them, the scheme returned a fairly little amount. I changed my scheme to a half an half with one half being balanced and the other being growth. Changing my scheme to half balanced and half growth dramatically increased the returns and I recommend looking into splitting your risk to provide diversification if your not completely sold on putting all your investment with a scheme that’s above your risk level.

So what is KiwiSaver? Maybe a silly question because it’s pretty commonly used but if you don’t know it is a scheme set up to supplement your income when you retire. Although the NZ Government provides the pension, the pension more than likely won’t cover ongoing costs like food, dining, travel, rates, home repairs, fuel, and these are just to name a few of the many many costs that one could have.

Why bother with KiwiSaver? My retirement is forever away!!! While this is true, you will get to some stage in your life and you’ll realise “Hey, i’m nearing retirement”, you’ll freak out, and you’ll be forced to work hard and come up with some way to provide a means to some extra cash when you get there.

Kiwisaver is made up of contributions plus investment gains, minus fees, withdrawals and taxes on any investment gains.

Your contributions are set at either 3%, 4%, or 8% of your income. Government contributions consist of a tax rebate of up to $521.43, this will be paid at $0.50 per $1.00 that you invest up to $1042.86. If I made that unclear, to get the whole $521.43 in tax credits you must contribute at least $1042.86. Employer contributions are mandatory for employers and are set at 3% of your income (Minus employer superannuation contribution tax).

Because KiwiSaver is an investment you will get a positive or negative return on your investment. Ideally you will get a positive return.

Fees each month may be charged. Taxes on any investment gains will be applied.

Well done, you have some savings!!! Cheers KiwiSaver for those colourful pictures!!!

You are able to withdraw part or all of your savings (So long as $1000 remains – so really not all of your savings at all) and put this towards a first home. On top of being able to withdraw a possibly handsome sum towards a first home, you also have the ability to apply for a first home grant!

Let me tell you a little about this KiwiSaver first home grant… There are two grants available, to be accepted there are a few rules like income brackets and balances in your savings, however this is more just to point out that there is an awesome grant scheme setup to subsidise first home buyers. These grants are given out by Housing NZ, paid to your solicitor, and are as follows:

- $3000 to $5000 for an existing home based on $1000 per year of contributing.

- $2000 to $10000 for a new home, or purchasing land for a new home to be built.

These grants effectively double in amount if you are purchasing with another person ie. Partner. That’s up to $10000 for an existing home, or up to $20000 for a new home to be purchased!

That’s pretty much the bulk of what having a KiwiSaver account is all about? But there is so much more to know about when it comes to selecting the correct fund!

Currently there are 25 scheme providers, as follows direct from the KiwiSaver website…

| Provider | URL | Phone Number |

|---|---|---|

| AmanahNZ KiwiSaver Limited | www.amanahnz.com | 0508 262 624 |

| AMP* | www.amp.co.nz | 0800 808 267 |

| ANZ Investments* | http://www.anz.co.nz/personal/ | 0800 736 034 |

| Aon New Zealand Ltd | www.aonkiwisaver.co.nz | 0800 266 463 |

| ASB Group Investments Ltd* | www.asb.co.nz | 0800 ASB RETIRE (0800 272 738) |

| BNZ* | www.bnz.co.nz | 0800 269 5494 |

| Civic Assurance | www.supereasy.co.nz | 04 978 1250 |

| Craigs Investment Partners Limited | www.craigsip.com | 0800 878 278 |

| Fisher Funds Management Ltd | www.kiwisaver.fisherfunds.co.nz | 0800 FF KIWI (0800 335 494) |

| Fisher Funds Management Limited* | www.ff2kiwisaver.co.nz | 0800 20 40 60 |

| Forsyth Barr | www.forsythbarr.co.nz | 0800 367 227 |

| Generate Investment Management Limited | www.generatekiwisaver.co.nz | 0800 855 322 |

| Grosvenor Financial Services* | www.grosvenorkiwisaver.co.nz | 0800 336 338 |

| Kiwi Wealth Limited* | www.kiwiwealth.co.nz | 0800 427 384 |

| Medical Assurance Society NZ Limited | www.mas.co.nz | 0800 800 MAS (0800 800 627) |

| Mercer (NZ) Limited* | www.mercerkiwisaverscheme.co.nz | 0508 542 578 |

| Milford Funds Limited | www.milfordkiwisaver.co.nz | 0800 662 345 |

| New Zealand Funds Management Limited | www.nzfunds.co.nz | 0800 NZF KIWI |

| NZ Anglican Church Pension Board | www.koinonia.org.nz | 0508 RETIRE (0508 738 473) |

| SBS Bank | www.lifestages.co.nz/kiwisaver/ | 0800 502 442 |

| Smartshares Limited | www.smartshares.co.nz | 0800 808 780 |

| Staples Rodway | www.staplesrodway.co.nz | 0800 446 499 |

| SuperLife Ltd | www.superlifekiwisaver.co.nz | 0800 278 737 |

| Taupo Moana Iwisaver Limited | www.iwiinvestor.co.nz | 0800 IWI 123 (0800 494 123) |

| Westpac* | www.westpac.co.nz | 0508 WPAC KIWI (0508 972 254) |

If you do not select a KiwiSaver scheme provider when you join or are automatically opted in, you will be provided with one of nine from a default list (* after provider name in the table above).

Each provider has their own schemes, the default scheme titles seem to be something like the ones BNZ have (We’ll use BNZ as an example of selecting the correct scheme shortly).

So what’s the best way to decide what scheme is for you?

In my opinion just like if one was to go looking for a mortgage, it’s probably best to do a wee bit of shopping around on the internet.

We’ll start by having a look at BNZ’s list of schemes on offer.

So here’s what to do when trying to find the best scheme!!!

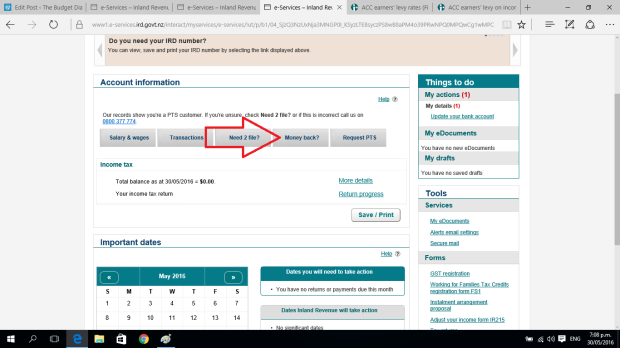

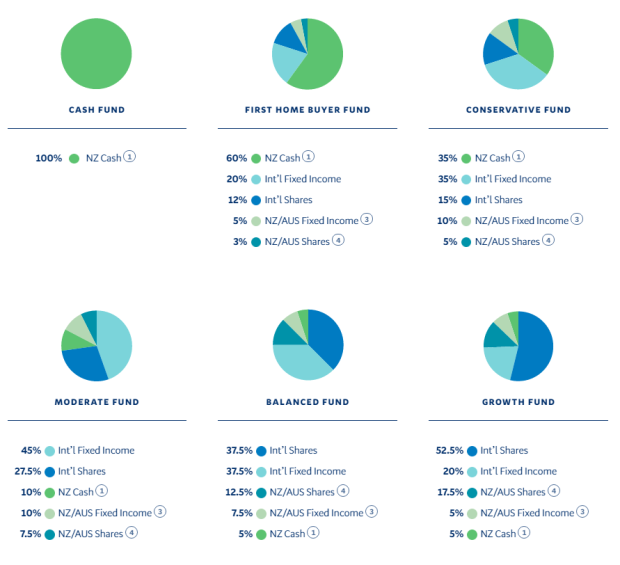

- Decide what scheme is best for me! I’ve had a look on BNZ’s website provided on the table above and their are six schemes to chose from:

- I doubt this means a heck of a lot to someone who’s only looking into KiwiSaver for the first time but this image above from BNZ’s website shows what each of the six schemes or funds invest in (There is further information on what investments each scheme invests in if you look at the disclosure statement of the fund). Fortunately for us there is another picture that explains who the funds best suit and how long they are best suited to be investing in that fund for?

- Take into account the data for each fund (Disclosure statement)! The provider is required to provide information generally in chart form of the funds performance, this is a key indicator on how the selected fund has performed in recent years. Although this does not guarantee a similar return as the past year, it gives an idea into how the fund has performed and an average overview of where it may potentially be returning? Again this information is available on the providers website.

- Be aware of the risks your taking with funds, there may be some sketchy funds in the list of 25 providers, it’s your job to be sure you don’t get sucked in! Check out the data for previous years and be sure that your happy with what the fund is investing in and where it is performing?

- Since joining KiwiSaver I have actually moved my funds over to BNZ and invest in the Growth Fund as I am planning on having KiwiSaver until retirement (Obviously) and because of this I am willing to ride out the bumps and reap the rewards when they pay off. BNZ’s Growth Fund for the last 3 years has had an average return on 7%, however last year returned 0.86%, scary I know! I guess what I am trying to point out is that there may be ups and downs but that’s to be expected with any investment (Just to different extents depending on the risk).

If anyone is wondering why I moved from Westpac to BNZ? I didn’t really like the lack of access with my funds (In general). I signed up to YouMoney. You money gives you access to a drag and drop GUI (Graphical user interface) making it really easy for budgeting (Access to 10 or more accounts). With YouMoney also came the ability to add an account that was directly linked to KiwiSaver and let me see the real time balance.

If you do want to move schemes or look into a little more about KiwiSaver, there is a huge wealth of knowledge on KiwiSaver’s website.

In my opinion saving up using the KiwiSaver scheme doesn’t actually save up that much in the grand scheme of things. If you take my income being $48k, that’s $151000 saved (48000*0.04*(65-20)) before interest and fees etc (my contribution plus my employers contribution, and that’s not taking into consideration that i’ll be withdrawing for a first home). If you add on the $19000 (On the low side) being the pension, it’s looking fairly do able with a budget in place but i’d definitely like a little more than $30000 P.A (If I were expecting to live to 80) when I retire (I’d expect some other form of supplementary income like a few rental properties). Hey its definitely a start but just food for thought there guys!

If you have any questions or comments feel free to comment below.

Thanks for reading.