If you have never filed a tax return you could be sitting on a gold mine!

Inland revenue allows for tax returns to be filed for the past 5 financial (ending March 31) years.

There are no hidden catches as the tax department is not made aware of you owing money unless you apply for a personal tax statement (I’ll get to that later).

Until recently I found myself paying to get a tax refund because I didn’t have any desire to bother learning how to do it myself. The sad thing about my logic is that it’s not a mission to do, in fact I think from memory it took roughly 5 minutes.

If you are using a company to file your return, here is a rundown of what you could potentially be paying. Woohoo (Or as you probably don’t know them NZ Tax Refunds) charge 14% on their smartphone app or 19.5% on their website. TaxRefunds.co.nz charge 18%. MyTax.co.nz charge 12% on their app and 15% on their website. Mytaxrefund.co.nz charge a flat $39 fee for anything above $70 and a $10 fee for anything less than $70.

Essentially you grant these companies the same powers that you hold by signing on the dotted line, they then so exactly the same thing you will, and then charge you up to 19.5% of your refund to claim it.

So let’s get down to business!

3 Steps!

Step 1. Go to the website www.ird.govt.nz and register. To register click register under MyIr (Refer to image below). To apply you need your IRD number which you can find out how to locate under the FAQ section of the IRD website. Once you have registered you can mange all IRD matters online, including changing your address, bank account details, tax codes and so much more.

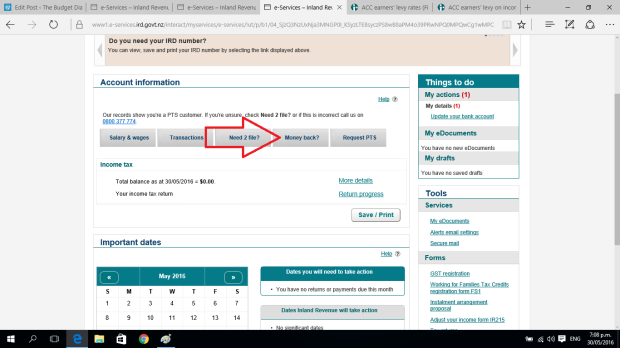

Step 2. Use the annual tax calculator to determine whether you could be owed a refund? You could be owed a refund if you worked part of the year, had more than one job, earned less than $48,000, or know that you were charged at a higher rate than normal for part of the financial year. The good thing about this tax calculator is that it is NON-OBLIGATION meaning if you owe the tax department money but are currently lacking funds to repay them then you can let time pass until the tax department chase you up (Not recommended). The tax calculator is located at the home tab under money back? (Refer to image).

Step 3. Now that you know you are owed money, go ahead and apply for a Personal Tax Summary. This sends your tax return data away to be finalised. To do this select Request PTS in similar fashion to when you selected Money Back. Select the tax year, tick the declaration box and click request.

Congrats! I did say there were only three steps however you still have to wait for your PTS to be finalised. Once finalised in will appear in your to do list in the sidebar of the website. You need to acknowledge this. When acknowledged you should get your refund within 5 working days.

Unlucky for some I never got a tax refund, instead I owe $300. In my opinion I should have been aware that I was under paying my taxes and should have put aside what wasn’t mine. Lessons learnt but now I know I can better prepare myself for next time.

If there is anything you’d like to know just comment below.

Thanks for reading,

Braeden.